Definitely something people don't seem to realize is that this can only give you back what you've put into it.

No idea, just that it's chatgpt running off of openAI's servers. It may only be using an earlier revision for that service.

They're not just being petty because they don't like him because the teevee told him he's bad, nope nosireebob.

Which is why they're locking up Al Gore too! (Right?)

Which is why they're locking up Al Gore too! (Right?)

I'm not CS/IT, but I'm adjacent to both. I haven't been impressed with the code I've asked chatgpt to write. Often it produces code that won't even compile, it doesn't know APIs so it just makes shit up that seems like it should be right, and it seems to spit out exactly what I'd expect from an algorithm designed to make stuff that looks like it should be correct but doesn't need to be.

If this level of work represents the base level from a CompSci student in 2023, then most CompSci students should have been failed out of their respective programs.

If this level of work represents the base level from a CompSci student in 2023, then most CompSci students should have been failed out of their respective programs.

Seems to me that ChatGPT got the answer wrong (as often happens with complicated questions). Poland as a country may have a long history, but unlike Switzerland, Poland ceased to exist for a period of time, so it is in fact a newer country.

Honestly, it doesn't need to be a yellow coin, and one of my favorite stories is a cautionary tale in this regard:

Once, aluminium was considered the most valuable precious metal. It was so valuable that Napoleon III had a set of aluminium dinnerware he showed off as an example of his wealth and power. It was so valuable that the tip of the Washington monument is capped with a 6 pound tip made out of aluminium, the largest piece of aluminium used at that time in history.

The thing is, it turns out that aluminium isn't some insanely rare metal, it's one of the most common metals on earth. Eventually, processes were developed to turn plentiful aluminium ores into the metal, and the price plummetted. Today, we make everything from disposable drink cans to vehicles with it. If you gave someone a 6 pound tip of aluminium, it wouldn't represent as much value as 2200 man-hours of labor, you can pick up that much in a manufactured item for less than a day's labor at minimum wage.

In such a way, gold and silver could become useless as monetary metals as well. If we were to perfect asteroid mining, for example, and we were able to economically exponentially increase the availability of the metals, then the rarity of gold would no longer be a limiting factor.

The benefits of using rare metals as money are twofold:

1. It keeps governments honest in terms of creating money. If the government wanted a dollar in 1900, then they needed to dig up approximately 1.5g of pure gold. Same with silver, you need the silver to have the silver. This isn't perfectly effective, since governments created "debasement" where they start with the base metal and add other cheaper metals until the currency is useless anyway.

2. It ensures there's a value floor on the currency. If you need a certain amount of a valuable metal to create a coin, then that coin will always be worth at least as much as the metal used to produce the coin. In fact, many countries considered their silver coins to be basically interchangeable at certain points in history since an ounce of fine silver is as good as any other ounce of fine silver. We've actually got a problem here today where our money has been so badly debased that even the crude facimiles are worth more in terms of their metals than the currency itself is worth, leading to us eliminating the penny because the copper coated zinc made no fiscal sense to issue, and I'm certain that within my lifetime other coins will also disappear.

Of course, despite what some people think, it isn't a perfect solution either.

1. It locks useful resources up in vaults and wallets, and that's bad because precious metals actually have good uses. When aluminium became widely available, it became used for many things it wasn't before, and gold and silver would likely be the same if it was equally available.

2. It also gives disproportionate power to miners. If I buy a computer from Dell, what business does a guy who owns a gold mine have getting in on that by selling the economy an ounce of gold that I'll solely use to tabulate the fact that I paid for the computer?

3. Fractional reserve banking sort of breaks the benefits of hard currencies, since you can have an economy that should have X dollars that instead has X+Y dollars where Y is dictated entirely by the banks. The danger of a bank run is built into the fact that fractional reserve banking is basically a scam where you tell two people they each have the same dollar.

4. Honesty just isn't very fun sometimes. Leverage and money printing are a two sided coin -- on one hand, the bad sides are that the value of people's hard work is degraded by the government's inflation tax, and the bust of the cycle means a lot of people get really badly hurt because they get in over their heads and take a lot of other people with them. On the other hand, the good sides are that inflation means debt is always shrinking at a certain rate, and there's always an incentive to make more money, and while the bust hurts, the boom feels great and sometimes something wonderful results from the risks people take during the boom such as our entire modern world.

Economics isn't simple because it isn't a hard science, it's a social science with hard constraints in the real world. If you have 1kg of bread you can't magic a second kg of bread into existence, but every single person can have a different opinion as to the value of that 1kg of bread and the aggregate of all those opinions matters, especially when people can choose to use their own resources to make more bread, or they can choose to consume their resources so there won't be any more bread, and a thousand other little things.

Once, aluminium was considered the most valuable precious metal. It was so valuable that Napoleon III had a set of aluminium dinnerware he showed off as an example of his wealth and power. It was so valuable that the tip of the Washington monument is capped with a 6 pound tip made out of aluminium, the largest piece of aluminium used at that time in history.

The thing is, it turns out that aluminium isn't some insanely rare metal, it's one of the most common metals on earth. Eventually, processes were developed to turn plentiful aluminium ores into the metal, and the price plummetted. Today, we make everything from disposable drink cans to vehicles with it. If you gave someone a 6 pound tip of aluminium, it wouldn't represent as much value as 2200 man-hours of labor, you can pick up that much in a manufactured item for less than a day's labor at minimum wage.

In such a way, gold and silver could become useless as monetary metals as well. If we were to perfect asteroid mining, for example, and we were able to economically exponentially increase the availability of the metals, then the rarity of gold would no longer be a limiting factor.

The benefits of using rare metals as money are twofold:

1. It keeps governments honest in terms of creating money. If the government wanted a dollar in 1900, then they needed to dig up approximately 1.5g of pure gold. Same with silver, you need the silver to have the silver. This isn't perfectly effective, since governments created "debasement" where they start with the base metal and add other cheaper metals until the currency is useless anyway.

2. It ensures there's a value floor on the currency. If you need a certain amount of a valuable metal to create a coin, then that coin will always be worth at least as much as the metal used to produce the coin. In fact, many countries considered their silver coins to be basically interchangeable at certain points in history since an ounce of fine silver is as good as any other ounce of fine silver. We've actually got a problem here today where our money has been so badly debased that even the crude facimiles are worth more in terms of their metals than the currency itself is worth, leading to us eliminating the penny because the copper coated zinc made no fiscal sense to issue, and I'm certain that within my lifetime other coins will also disappear.

Of course, despite what some people think, it isn't a perfect solution either.

1. It locks useful resources up in vaults and wallets, and that's bad because precious metals actually have good uses. When aluminium became widely available, it became used for many things it wasn't before, and gold and silver would likely be the same if it was equally available.

2. It also gives disproportionate power to miners. If I buy a computer from Dell, what business does a guy who owns a gold mine have getting in on that by selling the economy an ounce of gold that I'll solely use to tabulate the fact that I paid for the computer?

3. Fractional reserve banking sort of breaks the benefits of hard currencies, since you can have an economy that should have X dollars that instead has X+Y dollars where Y is dictated entirely by the banks. The danger of a bank run is built into the fact that fractional reserve banking is basically a scam where you tell two people they each have the same dollar.

4. Honesty just isn't very fun sometimes. Leverage and money printing are a two sided coin -- on one hand, the bad sides are that the value of people's hard work is degraded by the government's inflation tax, and the bust of the cycle means a lot of people get really badly hurt because they get in over their heads and take a lot of other people with them. On the other hand, the good sides are that inflation means debt is always shrinking at a certain rate, and there's always an incentive to make more money, and while the bust hurts, the boom feels great and sometimes something wonderful results from the risks people take during the boom such as our entire modern world.

Economics isn't simple because it isn't a hard science, it's a social science with hard constraints in the real world. If you have 1kg of bread you can't magic a second kg of bread into existence, but every single person can have a different opinion as to the value of that 1kg of bread and the aggregate of all those opinions matters, especially when people can choose to use their own resources to make more bread, or they can choose to consume their resources so there won't be any more bread, and a thousand other little things.

The extreme hypocrisy of the whole "incels are the bad guy" thing comes from many different angles. "Women aren't trophies except those guys over there lack trophies look at those losers!"

I mean, I see people so stupid they're posting about the budget Biden tabled knowing it had no chance of passing, so I'm sure there's people stupid enough to fall for that too.

Letting the enemy choose the battlefield is a massive failure in strategy. Most people are too smart to fall for it, but you only need a few stupid or mentally ill people to go along with it and suddenly you've got 2 years of "free" propaganda.

We forget that because our computers became so astronomically powerful that that old software works really well.

This is reality, right here.

Lots of Priuses are driving around and basically they're heavy, expensive, cramped corollas. The batteries don't even work anymore.

Lots of Priuses are driving around and basically they're heavy, expensive, cramped corollas. The batteries don't even work anymore.

That's a key part of why it isn't a currency: the use case for crypto at the moment is you convert Fiat into crypto with the hope that in the future someone will pay you more Fiat than you spent for it. That's how all of these companies were structured, and why they all went under when cryptos started to go down in price.

The fact that hypothetically you could find some electrical company in Texas that might accept a Bitcoin as payment, and you might find some water company in Indonesia that might accept Bitcoin, and a farmer somewhere in England who might accept Bitcoin for food, and a bus driver in Bangladesh who might accept Bitcoin, that doesn't make it a currency. It means that certain people are accepting a speculative investment in lieu of money, and whether you like it or not, they're only doing one of two things with it: either they are holding on to it with the hope that they will get more fiat currency for the Bitcoin tomorrow, or they are converting it to fiat currency so that they can buy the things that they actually need using something that is in fact a store value, a unit of account, and a medium of exchange.

There are anecdotes of people trading a tulip bulb for a house during tulip mania in the 1600s, because the tulip bulb was so valuable that it was considered a good trade, but that doesn't mean that a tulip bulb was a currency, it was a widely speculative investment, and that's where all of their value came from. The high price of tulip bulbs were never going to make back the money that they were demanding in actual flower sales.

The fact that hypothetically you could find some electrical company in Texas that might accept a Bitcoin as payment, and you might find some water company in Indonesia that might accept Bitcoin, and a farmer somewhere in England who might accept Bitcoin for food, and a bus driver in Bangladesh who might accept Bitcoin, that doesn't make it a currency. It means that certain people are accepting a speculative investment in lieu of money, and whether you like it or not, they're only doing one of two things with it: either they are holding on to it with the hope that they will get more fiat currency for the Bitcoin tomorrow, or they are converting it to fiat currency so that they can buy the things that they actually need using something that is in fact a store value, a unit of account, and a medium of exchange.

There are anecdotes of people trading a tulip bulb for a house during tulip mania in the 1600s, because the tulip bulb was so valuable that it was considered a good trade, but that doesn't mean that a tulip bulb was a currency, it was a widely speculative investment, and that's where all of their value came from. The high price of tulip bulbs were never going to make back the money that they were demanding in actual flower sales.

There's a lot of stuff that's isekai that isn't isekai, including stuff where someone is reincarnated in the past, or stuff where the person is already in a fantasy world but is reincarnated in another part of the fantasy world.

Given this looser definition of isekai, a lot of stuff is isekai.

Given this looser definition of isekai, a lot of stuff is isekai.

* There are no guarantees in life and ultimately you're responsible for your own success and happiness but accepting that is one of the only ways to actually accomplish those

Michael Avenatti is a guy who knows a thing or two about what it takes to get criminally convicted of something.

The word didn't come into existence in 2012. Reality has a long tail going back a trillion years, human civilization has a recorded history going back 20,000 years, and central banks have a long tail going back generations.

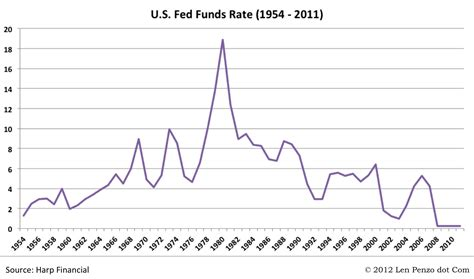

Reality check: Cryptos as a concept are only about 10 years old. Despite the magical lack of cryptos, CBs raised interest rates to reduce the money supply in the 50s, 60s, 70s, 80s, 90s, and 2000s. If we go by your prediction, you'd expect money supply should have increased less in the 2010s and onward since cryptos were there to "force them" to tighten money supply. Instead the opposite happened, and money has been printed more than ever before during the crypto era. That's an epic fail of a prediction.

The thing that causes CBs to act is the amount of buying power a currency has trading those dollars for real goods, services, or hard assets. When people are paying many more dollars for food, shelter, energy, that's what spurs CBs to action, not the price of fake Internet currency.

In reality, the scam crypto market actually likely moderates measurable inflation because dollars that might otherwise go into buying stuff that matters to Central Banks is going into trading around imaginary Techno Disney Dollars instead. It actually helps them print more money rather than forcing them to print less.

Reality check: Cryptos as a concept are only about 10 years old. Despite the magical lack of cryptos, CBs raised interest rates to reduce the money supply in the 50s, 60s, 70s, 80s, 90s, and 2000s. If we go by your prediction, you'd expect money supply should have increased less in the 2010s and onward since cryptos were there to "force them" to tighten money supply. Instead the opposite happened, and money has been printed more than ever before during the crypto era. That's an epic fail of a prediction.

The thing that causes CBs to act is the amount of buying power a currency has trading those dollars for real goods, services, or hard assets. When people are paying many more dollars for food, shelter, energy, that's what spurs CBs to action, not the price of fake Internet currency.

In reality, the scam crypto market actually likely moderates measurable inflation because dollars that might otherwise go into buying stuff that matters to Central Banks is going into trading around imaginary Techno Disney Dollars instead. It actually helps them print more money rather than forcing them to print less.