One important thing to understand is that inflation doesn't always raise prices, and rising prices isn't always caused by inflation.

Inflation is monetary, so the key to inflation is money supply.

To understand how governments and central banks inflate the money supply, you need to understand how money is created. Money is created when a loan is issued. The money didn't exist before, and comes to exist because the banks issue the money for the loan.

Under normal circumstances, there's a few ways a central bank can affect this.

One simple way is Qualitative Easing. This works by directly purchasing loans from banks and effectively replacing the loans with cash. This means that banks have the asset of a loan replaced with a liability of a deposit, so they can go out and issue more loans.

But why would banks need money if they can just create money? Well, that leads into the other way banks can change the money supply, and that's by changing the reserve requirement. The reserve requirement is how much money a bank is required to have on-hand in order to loan out money. The banking system in NZ, Hong Kong, and the US do not have reserve requirements at all at the moment, so theoretically banks can loan out unlimited money.

There's another reason banks need to have money in some form or another, and that's because of risk. Banks can loan money out all day long, but if you default, they take the hit. That's why banks in NZ and the US and HK still give out limited loans, because while they can loan out unlimited money, they can't afford to lose unlimited money. Central banks help reduce this risk because banks can borrow from the central bank as necessary, but all the loans in the world can't help if you've got a negative net worth.

So what can governments do?

Taxing and spending can increase or decrease prices by increasing or decreasing localized demand (this is exactly why you don't hand people money to help with higher prices. Overinflated housing markets around the world all have lots of government programs to "make it cheaper to buy a home", Canada being top among them), but they won't change inflation. The amount of money in the system doesn't really change. The one big thing that government does infuence is debt.

When the government takes out debt, that essentially introduces many, many new dollars to the system which in turn help produce even more dollars through new loans justified because of all the dollars in the system, increasing inflation.

When the government balanced budgets and starts paying down debts, that removes many, many dollars from the system which in turn helps to remove even more dollars from the economy because it's more difficult for banks to justify more loans, decreasing inflation.

At the beginning of this post, I said that higher prices are not inflation and inflation isn't necessarily higher prices, and once you understand that inflation is monetary and the effects of government policies on inflation, you start to see it. Prices happened to stay level for the past 15 years despite wildly inflationary policies around the world because other factors kept prices down.

One continuous impact of inflation is the creation of asset bubbles. Smart money knows it's shrinking in value, so it looks for things that grow in value to preserve itself. When this happens with lots of money at once, it becomes a self-fulfilling prophecy, such as what we saw in tech in the 90s, houses in the 2000s, tech again in the 2010s, and crypto more recently. These things aren't blowing up because they're special, they're blowing up because they're blowing up and the smart money is getting into them to protect itself which is a self-fulfilling prophecy. Money rushes in so prices rise so money rushes in.

I could keep going all day long, but one last thing to think about given my last point: People are pissed off at Elon Musk or Jeff Bezos or Bill Gates or Mark Zuckerberg. Guess what created these mega-rich people? It's inflation. They aren't special, they aren't smarter than people in mining or manufacturing who didn't get to become the richest people on the planet, they just got lucky and the massively inflationary policies since the late 1990s are the reason they could get lucky.

Inflation is monetary, so the key to inflation is money supply.

To understand how governments and central banks inflate the money supply, you need to understand how money is created. Money is created when a loan is issued. The money didn't exist before, and comes to exist because the banks issue the money for the loan.

Under normal circumstances, there's a few ways a central bank can affect this.

One simple way is Qualitative Easing. This works by directly purchasing loans from banks and effectively replacing the loans with cash. This means that banks have the asset of a loan replaced with a liability of a deposit, so they can go out and issue more loans.

But why would banks need money if they can just create money? Well, that leads into the other way banks can change the money supply, and that's by changing the reserve requirement. The reserve requirement is how much money a bank is required to have on-hand in order to loan out money. The banking system in NZ, Hong Kong, and the US do not have reserve requirements at all at the moment, so theoretically banks can loan out unlimited money.

There's another reason banks need to have money in some form or another, and that's because of risk. Banks can loan money out all day long, but if you default, they take the hit. That's why banks in NZ and the US and HK still give out limited loans, because while they can loan out unlimited money, they can't afford to lose unlimited money. Central banks help reduce this risk because banks can borrow from the central bank as necessary, but all the loans in the world can't help if you've got a negative net worth.

So what can governments do?

Taxing and spending can increase or decrease prices by increasing or decreasing localized demand (this is exactly why you don't hand people money to help with higher prices. Overinflated housing markets around the world all have lots of government programs to "make it cheaper to buy a home", Canada being top among them), but they won't change inflation. The amount of money in the system doesn't really change. The one big thing that government does infuence is debt.

When the government takes out debt, that essentially introduces many, many new dollars to the system which in turn help produce even more dollars through new loans justified because of all the dollars in the system, increasing inflation.

When the government balanced budgets and starts paying down debts, that removes many, many dollars from the system which in turn helps to remove even more dollars from the economy because it's more difficult for banks to justify more loans, decreasing inflation.

At the beginning of this post, I said that higher prices are not inflation and inflation isn't necessarily higher prices, and once you understand that inflation is monetary and the effects of government policies on inflation, you start to see it. Prices happened to stay level for the past 15 years despite wildly inflationary policies around the world because other factors kept prices down.

One continuous impact of inflation is the creation of asset bubbles. Smart money knows it's shrinking in value, so it looks for things that grow in value to preserve itself. When this happens with lots of money at once, it becomes a self-fulfilling prophecy, such as what we saw in tech in the 90s, houses in the 2000s, tech again in the 2010s, and crypto more recently. These things aren't blowing up because they're special, they're blowing up because they're blowing up and the smart money is getting into them to protect itself which is a self-fulfilling prophecy. Money rushes in so prices rise so money rushes in.

I could keep going all day long, but one last thing to think about given my last point: People are pissed off at Elon Musk or Jeff Bezos or Bill Gates or Mark Zuckerberg. Guess what created these mega-rich people? It's inflation. They aren't special, they aren't smarter than people in mining or manufacturing who didn't get to become the richest people on the planet, they just got lucky and the massively inflationary policies since the late 1990s are the reason they could get lucky.

The money printing may not have the same effects, but it's all monetary inflation.

Arguably, the effects of the main street bailout were better for the world because at least they were honest. The incredible malinvestment caused by 2008 has demolished many productive industries because not just money but talent has been siphoned off of other things to get lost in the black hole of tech. Hundreds of thousands of the generations smartest people working on chat apps and other useless crap. Trillions of dollars siphoned into useless crap instead of finding additional oil, gas and minerals. A total lack of investment in capital equipment such that key strategic manufacturing can't be done anymore without outsourcing it to our opponent in the next war.

At least the consumer side inflation is honest, it hits you in the face and you have to deal with it.

Arguably, the effects of the main street bailout were better for the world because at least they were honest. The incredible malinvestment caused by 2008 has demolished many productive industries because not just money but talent has been siphoned off of other things to get lost in the black hole of tech. Hundreds of thousands of the generations smartest people working on chat apps and other useless crap. Trillions of dollars siphoned into useless crap instead of finding additional oil, gas and minerals. A total lack of investment in capital equipment such that key strategic manufacturing can't be done anymore without outsourcing it to our opponent in the next war.

At least the consumer side inflation is honest, it hits you in the face and you have to deal with it.

A lot of economists get government spending wrong because telling the government spending too much money and not taxing enough is the right thing to do is a great way to stay employed by the government. Politicians love it, they want to be able to promise all things to all people.

Reality is much more complicated. There's a reason why the workforce labour participation rate is at record lows, labour productivity is plummeting, fertility is below replacement, and so on and so forth.

No matter where the government money goes, it takes up real resources that would have otherwise gone elsewhere. If the government is hiring, then those people get soaked up doing non-productive work. If the government gives money to companies that don't necessarily have the capcity to use it, then either you get stock buybacks or you get companies that get huge and are filled with non-productive or anti-productive people because there's money for it and spending tends to expand to fill budgets. If the government gives money to regular people, then some of those people will decide they don't need to be part of the productive economy.

In all 3 cases, you have people sucking up productivity but not producing any. That might make the numbers go up, but it doesn't improve quality of living for people as a whole.

Now, government spending *can* help improve productivity, but it has to be extremely carefully calculated because government cannot create wealth, it can only pull wealth from one spot and injected it into another spot. Medical doctors often pull something out of one part of the body and inject it into another part of the body and it results in positive results, but if you just do it randomly you'll kill the patient dead.

Reality is much more complicated. There's a reason why the workforce labour participation rate is at record lows, labour productivity is plummeting, fertility is below replacement, and so on and so forth.

No matter where the government money goes, it takes up real resources that would have otherwise gone elsewhere. If the government is hiring, then those people get soaked up doing non-productive work. If the government gives money to companies that don't necessarily have the capcity to use it, then either you get stock buybacks or you get companies that get huge and are filled with non-productive or anti-productive people because there's money for it and spending tends to expand to fill budgets. If the government gives money to regular people, then some of those people will decide they don't need to be part of the productive economy.

In all 3 cases, you have people sucking up productivity but not producing any. That might make the numbers go up, but it doesn't improve quality of living for people as a whole.

Now, government spending *can* help improve productivity, but it has to be extremely carefully calculated because government cannot create wealth, it can only pull wealth from one spot and injected it into another spot. Medical doctors often pull something out of one part of the body and inject it into another part of the body and it results in positive results, but if you just do it randomly you'll kill the patient dead.

The half application of Keynesianism is one of my biggest pet peeves in economics and politics.

We just finished having the longest economic recovery ever, and everyone everyone everyone went "we need to spend more money!" the whole time, despite under Keynes the right thing to do was to suck some of the air out of that recovery to save for tomorrow.

We just finished having the longest economic recovery ever, and everyone everyone everyone went "we need to spend more money!" the whole time, despite under Keynes the right thing to do was to suck some of the air out of that recovery to save for tomorrow.

The fact that the number of kids collapsing I think has a core economic basis. If people feel like they can, they inherently *want* to procreate -- that's a fundamental of life. The problem is that entire generations have felt like they can't for various reasons.

The Millennials were actually a relative population boom, that's why the generation is called "Echo boom" by some sociologists. But then those kids grew up into situations where they didn't feel they could have kids of their own, and so there's serious problems

[sauce on "echo boom"] https://www.cbsnews.com/news/the-echo-boomers-01-10-2004/

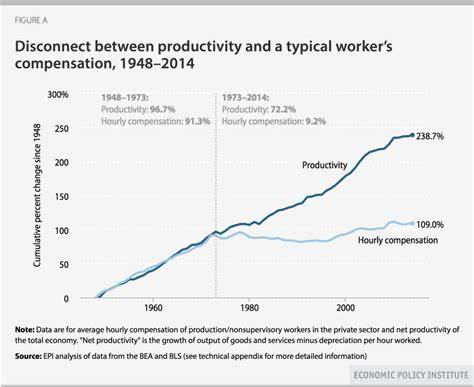

The attached image demonstrates that the working class is getting a short end of the stick. Everyone is working harder and harder for less and less. In times where disparities like this add up, there's often bad times for everyone ahead. The French Revolution was one such time in history, for example.

The Millennials were actually a relative population boom, that's why the generation is called "Echo boom" by some sociologists. But then those kids grew up into situations where they didn't feel they could have kids of their own, and so there's serious problems

[sauce on "echo boom"] https://www.cbsnews.com/news/the-echo-boomers-01-10-2004/

The attached image demonstrates that the working class is getting a short end of the stick. Everyone is working harder and harder for less and less. In times where disparities like this add up, there's often bad times for everyone ahead. The French Revolution was one such time in history, for example.

- replies

- 1

- announces

- 0

- likes

- 0

It's a combination of many factors. Tiny income growth often not keeping up with inflation is one, high cost of living in terms of finding a stable place to live is another, both the drive to get women into the workforce and the requirement that they get into the workforce to be able to maintain a reasonable quality of living is yet another.

My wife really felt a peer pressure not to be a stay at home wife and mother. That's what our culture is doing to women. She rejected society's demands because that's what she wanted, and I feel our family is happier for it. The thing is, not only did she have to reject society's pressure to go fail to become a CEO, but we also have to walk an economic tightrope to be able to attain the ability to have such a lifestyle.

My wife really felt a peer pressure not to be a stay at home wife and mother. That's what our culture is doing to women. She rejected society's demands because that's what she wanted, and I feel our family is happier for it. The thing is, not only did she have to reject society's pressure to go fail to become a CEO, but we also have to walk an economic tightrope to be able to attain the ability to have such a lifestyle.

We're told a lot of things.

One interesting thing you hear from immigrants is that they're shocked at how expensive just living is. Many move back after realizing it isn't actually the land of milk and honey they've been promised.

One interesting thing you hear from immigrants is that they're shocked at how expensive just living is. Many move back after realizing it isn't actually the land of milk and honey they've been promised.

It doesn't really end up sustainable though. Within a generation the kids of that immigrant are living the same as everyone else.

The Amish is a different beast, because they're completely outside of the system we've built. Certainly seems to be evidence that there is another way.

I expect big changes in the next couple generations. The whole world looks different when populations start to shrink, starting with a massive improvement in quality of life for the working class. That's why governments and corporations are so terrified of a shrinking population.

The Amish is a different beast, because they're completely outside of the system we've built. Certainly seems to be evidence that there is another way.

I expect big changes in the next couple generations. The whole world looks different when populations start to shrink, starting with a massive improvement in quality of life for the working class. That's why governments and corporations are so terrified of a shrinking population.

It can for a while, but not forever. We've got a real crisis brewing, because the few productive people that are left are dying of old age. Those immigrants are going to turn right back around more and more as they realize they're not going to get ahead coming here.

Automation is a big topic, but let me just say this: It can be useful in spots to reduce labour, but it's not nearly as straightforward as proponents would have you believe. You need a bunch of highly productive people to make the highly productive machines and to make them work and keep working. The promise of fractal automation is a lie.

Automation is a big topic, but let me just say this: It can be useful in spots to reduce labour, but it's not nearly as straightforward as proponents would have you believe. You need a bunch of highly productive people to make the highly productive machines and to make them work and keep working. The promise of fractal automation is a lie.

https://home.treasury.gov/data/troubled-assets-relief-program

According to the treasury, The TARP bank bailout was ultimately a program in the green by 7 billion dollars.

That's not including all the other haywire stuff mind you, just TARP itself.

According to the treasury, The TARP bank bailout was ultimately a program in the green by 7 billion dollars.

That's not including all the other haywire stuff mind you, just TARP itself.

I'd personally have preferred we let the companies that made unreasonable risks just fail completely. It would have hurt a lot more in the short term, but the idea that megacorps need to be bailed out is a great way to make sure we have nothing but megacorps :(

I'd argue the past 20 years were great depression levels of bad for main street anyway, all while we turn into a feudal society as the megacorps we saved just used our own money to snatch up all the assets normal people who aren't immortal soulless legal constructs need to not die.

I just think about what's happened to home prices, what's happened to rents, what's happened to energy, and importantly what hasn't happened to wages. It's been the greatest wealth transfer in the history of the world, and it's created several of the richest people in the history of the world.

I understand why we might not want to feel the pain, but every time we take that heroin, it's one more step away from ever going straight.

I just think about what's happened to home prices, what's happened to rents, what's happened to energy, and importantly what hasn't happened to wages. It's been the greatest wealth transfer in the history of the world, and it's created several of the richest people in the history of the world.

I understand why we might not want to feel the pain, but every time we take that heroin, it's one more step away from ever going straight.

I doubt the millennials will be any different either. Probably not Gen Z either. It won't be until the current generations of adults have broken everything so badly there's no can left to kick that some poor bastards in the future will have to actually do the right thing.

Getting a deal off an insanely overinflated price still isn't a deal. The average house price in Canada in 2000 was $164,000. The average house price in 2011 was closer to $340,000. The average house price in 2022 in Canada is over $800,000. That isn't up and down, it's up and up more and up more still. That's not a sane number. It's a perfect microcosm of the reality of the past 20 years. Some people's numbers went up so much that we can ignore all the people whose numbers can't.

The truth is that we've had bailout after bailout. 2001, 2003, 2008, 2020. They hit the nitrous again and again, cranked more cocaine and more heroin into the system to make the numbers rise. It made the numbers rise, but it isn't healthy. Instead of avoiding the withdrawl, we ought to just stop the constant cocaine and heroin and accept the pain so we can get back to being healthy.

Homeless populations are at all time highs. Drug deaths are at all time highs. Gangs infest even small towns. Yeah, there are big winners, but there's a lot of people realizing they can't even play.

The rate hikes and QT are a good start, and I hope they continue. They're going to have to be paired with government policy that stops selling our kids kids into slavery and commits to balanced budgets. Households need to deleverage. Governments need to deleverage. Investors need to deleverage. Money isn't the thing we're trying to achieve, it's what you can do with the money, and the malinvestment caused by excess debt means real resources that could be put towards real productivity are instead being spent on frivolousness.

The truth is that we've had bailout after bailout. 2001, 2003, 2008, 2020. They hit the nitrous again and again, cranked more cocaine and more heroin into the system to make the numbers rise. It made the numbers rise, but it isn't healthy. Instead of avoiding the withdrawl, we ought to just stop the constant cocaine and heroin and accept the pain so we can get back to being healthy.

Homeless populations are at all time highs. Drug deaths are at all time highs. Gangs infest even small towns. Yeah, there are big winners, but there's a lot of people realizing they can't even play.

The rate hikes and QT are a good start, and I hope they continue. They're going to have to be paired with government policy that stops selling our kids kids into slavery and commits to balanced budgets. Households need to deleverage. Governments need to deleverage. Investors need to deleverage. Money isn't the thing we're trying to achieve, it's what you can do with the money, and the malinvestment caused by excess debt means real resources that could be put towards real productivity are instead being spent on frivolousness.

I wish I could dispute that, but it seems clear that the final result is absolute totalitarian central economic planning in a way that looks like falling into a bottomless pit forever.

There's also the issue of malinvestment caused by debt bubbles.

You *could* spend money building houses and make a linear amount of profit, or you could spend money building useless tech tech and potentially make exponential profits. Money tends to go where it'll grow, especially in an environment like the past 20 years where if it isn't continuously growing massively then you're basically losing money. People who would otherwise be risk averse have to be extremely open to high risk because that's the only way to get ahead.

Just look at the crypto market. At its peak, bitcoin alone was worth well over 2 trillion dollars, going towards 3 trillion. That's money that went into this tech tech thing that wasn't going into building new houses, new factories, or anything else productive. A lot of it went into building single purpose ASICs or video cards, and we didn't need more single purpose ASICs or video cards. Same with a lot of the overinflated tech stocks. That money ended up going into companies that just ended up getting bloated and lumbering because the money was going into a thing that went up because it went up causing it to go up.

People think money is just money, but it isn't money is a representation of the productivity of an economy. When money is spent on things that are useless, it means that the productivity is going towards useless things and isn't going towards useful things.

You *could* spend money building houses and make a linear amount of profit, or you could spend money building useless tech tech and potentially make exponential profits. Money tends to go where it'll grow, especially in an environment like the past 20 years where if it isn't continuously growing massively then you're basically losing money. People who would otherwise be risk averse have to be extremely open to high risk because that's the only way to get ahead.

Just look at the crypto market. At its peak, bitcoin alone was worth well over 2 trillion dollars, going towards 3 trillion. That's money that went into this tech tech thing that wasn't going into building new houses, new factories, or anything else productive. A lot of it went into building single purpose ASICs or video cards, and we didn't need more single purpose ASICs or video cards. Same with a lot of the overinflated tech stocks. That money ended up going into companies that just ended up getting bloated and lumbering because the money was going into a thing that went up because it went up causing it to go up.

People think money is just money, but it isn't money is a representation of the productivity of an economy. When money is spent on things that are useless, it means that the productivity is going towards useless things and isn't going towards useful things.

https://torontolife.com/real-estate/toronto-highrises/

Toronto in particular has more construction than any other city in North America, so money is being spent, but the entire real economy is affected by capital being sucked up by malinvestment and building is no different. Even a booming industry is held back because the best and brightest are being snatched up to work on useless crap because useless crap pays better in this economy.

That being said, the housing is also malinvestment. They cost so much because people can borrow so much money they can't afford to borrow and so solid purchases from good customers are being crowded out by investment from companies or individuals flush with borrowed cash. The money being added drives up prices and the prices being driven up drives further money being added.

https://www.cbc.ca/news/canada/toronto/investors-in-ontario-real-estate-market-1.6258199

The only positive is that with mortgage rates on the rise, prices will crash. Not good for irresponsible borrowers or irresponsible lenders, but good for society because the cost of living we were ignoring because numbers were going up was having massive negative knock on effects financially, economically, and socially.

Toronto in particular has more construction than any other city in North America, so money is being spent, but the entire real economy is affected by capital being sucked up by malinvestment and building is no different. Even a booming industry is held back because the best and brightest are being snatched up to work on useless crap because useless crap pays better in this economy.

That being said, the housing is also malinvestment. They cost so much because people can borrow so much money they can't afford to borrow and so solid purchases from good customers are being crowded out by investment from companies or individuals flush with borrowed cash. The money being added drives up prices and the prices being driven up drives further money being added.

https://www.cbc.ca/news/canada/toronto/investors-in-ontario-real-estate-market-1.6258199

The only positive is that with mortgage rates on the rise, prices will crash. Not good for irresponsible borrowers or irresponsible lenders, but good for society because the cost of living we were ignoring because numbers were going up was having massive negative knock on effects financially, economically, and socially.

https://lotide.fbxl.net/posts/16888

The above link is pretty long, but reviews a large number of recessions and shows a few commonalities. The key reason to look at it as a debt bubble is that excess money causes an expansion of credit which runs into certain industries which appear profitable to everyone at the same time, which causes massive over investment in those industries, and later on when it turns out that they can't possibly be profitable enough to justify the overinvestment, and this is the key thing, the value collapses and all of the leveraged investors lose not just the money that they have but the money that they don't have which ends up causing the downward part of the cycle, where Banks lose money on a whole bunch of loans which can cause Bank closures, it causes a reduction in the money supply, it causes tightening of credit, which overall means that there's less money moving around the economy, which leads to recession.

The key is leverage. Leverage means that with a relatively small amount of money you can create a relatively large amount of money when things are moving up, but it also means that you can destroy a relatively large amount of money with a relatively small amount of money when things are moving down.

In some ways it's like a casino. Nobody ever lost their home gambling money they could afford to lose. People lose their home when they are gambling with debt they can't afford to lose.

The above link is pretty long, but reviews a large number of recessions and shows a few commonalities. The key reason to look at it as a debt bubble is that excess money causes an expansion of credit which runs into certain industries which appear profitable to everyone at the same time, which causes massive over investment in those industries, and later on when it turns out that they can't possibly be profitable enough to justify the overinvestment, and this is the key thing, the value collapses and all of the leveraged investors lose not just the money that they have but the money that they don't have which ends up causing the downward part of the cycle, where Banks lose money on a whole bunch of loans which can cause Bank closures, it causes a reduction in the money supply, it causes tightening of credit, which overall means that there's less money moving around the economy, which leads to recession.

The key is leverage. Leverage means that with a relatively small amount of money you can create a relatively large amount of money when things are moving up, but it also means that you can destroy a relatively large amount of money with a relatively small amount of money when things are moving down.

In some ways it's like a casino. Nobody ever lost their home gambling money they could afford to lose. People lose their home when they are gambling with debt they can't afford to lose.

One important thing to keep in mind is that they're lying about inflation.

Over time, they've changed the way they calculate inflation to reduce the number without reducing inflation itself.

There's a few different ways. For one, lets say you can't afford steak anymore because it gets too expensive so you move to chicken, but then later you can't afford chicken so you buy organ meats. Things have gotten way more expensive, but they twist it so technically there was no inflation because you're paying the same!

For another, let's say that you bought a smart phone 10 years ago for $400, but today the smart phone is $1200. Well, they just say "Yeah but the new one is way better!" so despite your objective cost of living going way up, there was no inflation!

Yet another, let's say your rent goes up 400% and house prices go up 400%. It's totally cool because instead of looking at rents or house prices, they go to a homeowner and ask "hey, hypothetically if you had to rent a replacement for your home, how much would you expect to pay?", and the homeowners consistently guess way lower than the real value so there was no inflation!

If we were to use the old method of calculating inflation, we had fairly high inflation after 2008, and presently we are experiencing some of the highest inflation in history, forget the past 40 years.

http://www.shadowstats.com/alternate_data/inflation-charts

Doing that completely changes the conversation. When you account for the actual rises in cost of living rather than the doctored cost of living, the true cost of the constant bailouts becomes obvious. It's not just the cost of the bailouts, but the reduction in virtually everyone's cost of living. If you're an oligarch who owns assets that only go up then you're fine, but if you're someone who earns a wage then the inflation tax robs you of your wages forever from the moment it takes effect.

There's somthing in finance called the "rule of 72" where if you divide 72 by the growth rate of a thing you see how long until prices double in years. If inflation was really 2% then prices would only double every 36 years. If inflation is really 7%, then prices would double every 10 years. I know many of my bills have doubled in the past 10 years. Groceries have far more than doubled. Rent has far more than doubled. energy has almost doubled. Many cars have doubled in MSRP. Most technology has more than doubled in price.

Like... What's left? Everyone from the poorest of the poor to the the upper middle class of wage earners are paying the inflation tax every year watching their wages disintegrate, meanwhile fighting just to get 2% raises.

Don't bail out main street, don't bail out the banks. Return to responsibility and let the good investments succeed and the bad investments fail, and let people be responsible for taking care of themselves because they're going to do a better job than the government has, clearly.

Over time, they've changed the way they calculate inflation to reduce the number without reducing inflation itself.

There's a few different ways. For one, lets say you can't afford steak anymore because it gets too expensive so you move to chicken, but then later you can't afford chicken so you buy organ meats. Things have gotten way more expensive, but they twist it so technically there was no inflation because you're paying the same!

For another, let's say that you bought a smart phone 10 years ago for $400, but today the smart phone is $1200. Well, they just say "Yeah but the new one is way better!" so despite your objective cost of living going way up, there was no inflation!

Yet another, let's say your rent goes up 400% and house prices go up 400%. It's totally cool because instead of looking at rents or house prices, they go to a homeowner and ask "hey, hypothetically if you had to rent a replacement for your home, how much would you expect to pay?", and the homeowners consistently guess way lower than the real value so there was no inflation!

If we were to use the old method of calculating inflation, we had fairly high inflation after 2008, and presently we are experiencing some of the highest inflation in history, forget the past 40 years.

http://www.shadowstats.com/alternate_data/inflation-charts

Doing that completely changes the conversation. When you account for the actual rises in cost of living rather than the doctored cost of living, the true cost of the constant bailouts becomes obvious. It's not just the cost of the bailouts, but the reduction in virtually everyone's cost of living. If you're an oligarch who owns assets that only go up then you're fine, but if you're someone who earns a wage then the inflation tax robs you of your wages forever from the moment it takes effect.

There's somthing in finance called the "rule of 72" where if you divide 72 by the growth rate of a thing you see how long until prices double in years. If inflation was really 2% then prices would only double every 36 years. If inflation is really 7%, then prices would double every 10 years. I know many of my bills have doubled in the past 10 years. Groceries have far more than doubled. Rent has far more than doubled. energy has almost doubled. Many cars have doubled in MSRP. Most technology has more than doubled in price.

Like... What's left? Everyone from the poorest of the poor to the the upper middle class of wage earners are paying the inflation tax every year watching their wages disintegrate, meanwhile fighting just to get 2% raises.

Don't bail out main street, don't bail out the banks. Return to responsibility and let the good investments succeed and the bad investments fail, and let people be responsible for taking care of themselves because they're going to do a better job than the government has, clearly.

If we keep on bailing out people who make bad decisions, then they will continue to make bad decisions. They will continue to need bigger and bigger bailouts, and that's what we're seeing, until it doesn't matter because there won't be anything left to bail anyone out with. I think we're pretty much there now.

It's not pretty, but it's correct. You have two classes of people: Net Tax providers and net tax consumers. If you let the net tax consumers vote, then they will inevitably vote for more things for the net tax providers to pay for. From there, the only option is for the leadership to try to make more and more people net tax consumers to placate them and buy their votes.

It could potentially work if you had a unified culture that was incredibly stringent on supporting the common good, but by definition we're not that. It appears that we don't want to be that either, and that's ok, but it does mean there needs to be less universality to the universal.