I'm sure you're just joking, but I don't understand why anyone has savings. With inflation on the menu, having cash just doesn't make any sense.

- replies

- 2

- announces

- 1

- likes

- 2

Which currency resists inflation? Virtually every one I'm aware of has been marching in lockstep towards valuelessness

A currency needs to do three things: it needs to be a store value, a unit of account, and a medium of exchange.

As a store of value, it's a pretty poor one. Something like 80% of people who invested in Bitcoin are underwater. From the peak, Bitcoin has lost half it's value even with it's latest gains, making it even worse than most of the world's Fiat currencies in terms of retaining value. It's extremely volatile regardless, so you could definitely make the argument that I'm cherry picking, but the fact is something that may go dramatically up or dramatically down at any time isn't a good store of value.

For the same reason, it's a terrible unit of account. How many bitcoins is your house worth? From day to day, week to week, month to month, year to year, that number is dramatically different. Therefore, the way that Bitcoin tends to be used where it is pretended to be used as a currency is something is priced in US dollars, and the person will use their local currency to purchase Bitcoin at the equivalent value, then the recipient will convert that Bitcoin into their local currency.

Finally, it's not a very good medium of exchange. If I go to the store and want to buy something with my Fiat currency, I either hand them the currency or I use my bank card and the money comes directly out of my account. If I go to the store and want to buy something with my bitcoin, for pretty much anything that I want to buy that's not an option. I have to sell my Bitcoin into the local currency and purchase what I want with the actual currency.

I'm not the only one saying this either. A number of people who are very much into cryptos have come out and said that Bitcoin is not a currency. Some crypto companies have gone in front of the US Congress under oath and said that Bitcoin is not a currency. It's an investment vehicle, it's a property, but it isn't a currency.

In that sense, holding Bitcoin isn't savings, so investing in it with the hope to beat inflation isn't savings, it's just a other asset class in an investment portfolio, and having your money in that investment portfolio is my point.

As a store of value, it's a pretty poor one. Something like 80% of people who invested in Bitcoin are underwater. From the peak, Bitcoin has lost half it's value even with it's latest gains, making it even worse than most of the world's Fiat currencies in terms of retaining value. It's extremely volatile regardless, so you could definitely make the argument that I'm cherry picking, but the fact is something that may go dramatically up or dramatically down at any time isn't a good store of value.

For the same reason, it's a terrible unit of account. How many bitcoins is your house worth? From day to day, week to week, month to month, year to year, that number is dramatically different. Therefore, the way that Bitcoin tends to be used where it is pretended to be used as a currency is something is priced in US dollars, and the person will use their local currency to purchase Bitcoin at the equivalent value, then the recipient will convert that Bitcoin into their local currency.

Finally, it's not a very good medium of exchange. If I go to the store and want to buy something with my Fiat currency, I either hand them the currency or I use my bank card and the money comes directly out of my account. If I go to the store and want to buy something with my bitcoin, for pretty much anything that I want to buy that's not an option. I have to sell my Bitcoin into the local currency and purchase what I want with the actual currency.

I'm not the only one saying this either. A number of people who are very much into cryptos have come out and said that Bitcoin is not a currency. Some crypto companies have gone in front of the US Congress under oath and said that Bitcoin is not a currency. It's an investment vehicle, it's a property, but it isn't a currency.

In that sense, holding Bitcoin isn't savings, so investing in it with the hope to beat inflation isn't savings, it's just a other asset class in an investment portfolio, and having your money in that investment portfolio is my point.

In my view, if you invested your savings in tax efficient vehicles like RRSPs (in Canada, equivalent to a 401k in the US I believe, but I don't know if you can use 401ks for what I'm about to talk about), then you can get a tax refund for holding the money, potentially get growth from the money greater than the 0.01% the savings account would give you, and you can cash it out at a lower tax rate in the event you need it.

Couldn't you say that for literally anything? They could ban cryptos. They could bail-in your savings and they're gone. They could confiscate gold.

They don't even need to successfully ban cryptos, they just need to make it illegal to convert cryptos to fiat.

If they can take Dick Masterson's credit card privileges away for newproject2, I guarantee you they can take away coinbase's credit card privileges, and suddenly crypto is no longer a thing.

If they can take Dick Masterson's credit card privileges away for newproject2, I guarantee you they can take away coinbase's credit card privileges, and suddenly crypto is no longer a thing.

One thing with the whole discussion about mortgages is that it's sort of like the industrial revolution in the sense that it's all well and good to say you shouldn't use this thing, but you're competing in a marketplace with everyone else; if you take an hour to make something and they take a second you can't just sell your widget at 3000x the price and expect anyone to pay.

We live in a world with banking. Even for the people who are at the top end of the income curve, there simply isn't a reasonable option to own most homes without incurring debt. Because banking exists, leverage is a force multiplier that allows people who don't make a lot of money to spend quite a lot of money on certain things. That means that the price of certain things is simply higher than it would be otherwise, and there's nothing you can really do about that.

However, just because you can't throw out the concept entirely doesn't mean that you need to put a blindfold on and mindlessly jump off a cliff. You can run a phossy jaw factory that hurts people and the environment, or you can run your factory following good ethics and be a positive force for your customers, your employees, and your community. Likewise, you can take out the absolute maximum amount the bank is willing to give you and live with massive payments until the day you die and the house belongs to the bank, or you can choose to live within your means and buy less house than the bank says you can afford, so you plan to pay off your home from day 1 and in as short a time as possible and actually own the things you buy. From what I've seen, owning your own home in the clear is one of the most important things to being able to successfully retire.

Along the way though, you have to think for yourself because no one's going to do it for you.

We live in a world with banking. Even for the people who are at the top end of the income curve, there simply isn't a reasonable option to own most homes without incurring debt. Because banking exists, leverage is a force multiplier that allows people who don't make a lot of money to spend quite a lot of money on certain things. That means that the price of certain things is simply higher than it would be otherwise, and there's nothing you can really do about that.

However, just because you can't throw out the concept entirely doesn't mean that you need to put a blindfold on and mindlessly jump off a cliff. You can run a phossy jaw factory that hurts people and the environment, or you can run your factory following good ethics and be a positive force for your customers, your employees, and your community. Likewise, you can take out the absolute maximum amount the bank is willing to give you and live with massive payments until the day you die and the house belongs to the bank, or you can choose to live within your means and buy less house than the bank says you can afford, so you plan to pay off your home from day 1 and in as short a time as possible and actually own the things you buy. From what I've seen, owning your own home in the clear is one of the most important things to being able to successfully retire.

Along the way though, you have to think for yourself because no one's going to do it for you.

The reason people invest in Bitcoin is solely that they hope it will someday reach hyperbitcoinization, or the mass adoption of Bitcoin for everyday use. At that point, someone who has a few Bitcoin would be a multi billionaire if you compare the value of all currency to the number of bitcoins. The instability of the price therefore is the intended purpose of the investment. If the real value of a bitcoin stayed the same for a long enough period, the market would likely collapse.

I'm pushing back hard on your statements that bitcoin is stable and that businesses can price their goods in bitcoin.

I went back and found 10 years of data showing what the price of bitcoin was in US dollars in March (in 2013 I started in April because that's when the data starts)

Month Year USD/btc, yoy % Change

apr 2013, 135 -

mar 2014, 457 238

mar 2015, 243 -46

mar 2016, 415 70

mar 2017, 1078 159

mar 2018, 6897 539

mar 2019, 4103 -40

mar 2020, 6403 56

mar 2021, 58668 816

mar 2022, 47043 -19

mar 2023, 22367 -52

This data shows something with ridiculously volatile value. It might double or triple, or quadruple, or quintuple, or octople, or it might drop by 20%, 40%, or 50%.

Central banks try to keep their currencies stuck at about 2% change. At 8%, they're in full panic mode, implementing QT and raising rates at record speeds.

So imagine now that you're a business trying to price your goods in an environment like this. One year you have to half your prices, then the next year you have to double them, then half them again, and again, and then you have to drop your prices to 1/5th what you previously charge, then the next you have to double them, then you have to halve them, then you have to drop your prices to 1/8th of what you charged, then you have to increase them by a quarter, then double them again.

How could you even stay in business in such an environment? You agree to purchase materials and the cost could double or halve from ordering the materials and agreeing upon a price to actually having the materials in your warehouse. You could agree to hire someone and each week the wage you're paying changes in purchasing power.

How do you do accounting for a year? How can you plan ahead when you don't know if a bitcoin is going to be worth $5,000 or $50,000? How much profit will you make this year? Even if you can predict that, how much value does that profit represent?

This data should be proof positive that it isn't a store of value and isn't a unit of account. You don't know how much value you've stored after 1 year, you don't know how much stuff costs after 1 year, you don't know what to charge for stuff after 1 year, you don't know what to pay someone after 1 year.

I went back and found 10 years of data showing what the price of bitcoin was in US dollars in March (in 2013 I started in April because that's when the data starts)

Month Year USD/btc, yoy % Change

apr 2013, 135 -

mar 2014, 457 238

mar 2015, 243 -46

mar 2016, 415 70

mar 2017, 1078 159

mar 2018, 6897 539

mar 2019, 4103 -40

mar 2020, 6403 56

mar 2021, 58668 816

mar 2022, 47043 -19

mar 2023, 22367 -52

This data shows something with ridiculously volatile value. It might double or triple, or quadruple, or quintuple, or octople, or it might drop by 20%, 40%, or 50%.

Central banks try to keep their currencies stuck at about 2% change. At 8%, they're in full panic mode, implementing QT and raising rates at record speeds.

So imagine now that you're a business trying to price your goods in an environment like this. One year you have to half your prices, then the next year you have to double them, then half them again, and again, and then you have to drop your prices to 1/5th what you previously charge, then the next you have to double them, then you have to halve them, then you have to drop your prices to 1/8th of what you charged, then you have to increase them by a quarter, then double them again.

How could you even stay in business in such an environment? You agree to purchase materials and the cost could double or halve from ordering the materials and agreeing upon a price to actually having the materials in your warehouse. You could agree to hire someone and each week the wage you're paying changes in purchasing power.

How do you do accounting for a year? How can you plan ahead when you don't know if a bitcoin is going to be worth $5,000 or $50,000? How much profit will you make this year? Even if you can predict that, how much value does that profit represent?

This data should be proof positive that it isn't a store of value and isn't a unit of account. You don't know how much value you've stored after 1 year, you don't know how much stuff costs after 1 year, you don't know what to charge for stuff after 1 year, you don't know what to pay someone after 1 year.

What you said above seems completely divorced from reality.

It's divorced from the reality of how bitcoin are created, how typical users would acquire bitcoin, how bitcoin would typically be used, how currency markets work, and perhaps most importantly what's required under the law at the end of the day.

Bitcoin are typically created by miners. These are people or companies running computer systems using either GPUs or ASICs that complete the equations that run bitcoin behind the scenes. There are two methods for the miners to get paid: For a little while longer just mining pays in bitcoin as the supply grows, but in addition you can attach fees to a transaction that the miner can collect. The miners then convert those bitcoin into fiat currency because they are in the business of making money. More on that in a moment.

It's possible to mine bitcoin yourself, but the amounts you'd need to live a life or run a business aren't possible to mine without an unreasonable investment in mining hardware and at that point you're just a miner. Typically, end users of bitcoin will trade their own fiat currency for bitcoin using an exchange. This is not unique to cryptocurrencies; if I were to take a trip to the US, I would have to use a currency exchange to convert my Canadian dollars to US dollars similarly.

You can't just pretend that bitcoin don't have value relative to other currencies, because currencies other than bitcoin aren't traded for in order to get rich; People around the world buy Canadian dollars, for example, because they want Canadian oil, or metals, or wood, or pulp and paper, or food products, or to stay in Canadian hotels or eat in Canadian restaurants or to hire Canadian engineering firms or contractors or to buy Canadian houses or to pay Canadian taxes. The worth of that dollar is in the goods and services you can buy with that dollar. You can say "oh, the value of a bitcoin relative to the USD doesn't matter" all you want, but if I can sell my bitcoin for enough to buy a new Tesla one year and I can sell my bitcoin for enough to buy a used Toyota Corolla the next, that's a real difference in what's sitting in my driveway, and you'll care how much you're getting paid in how much stuff you can buy a lot.

Since Bitcoin isn't a currency, it isn't a good store of value, isn't a unit of account, isn't a method of exchange, you can't measure the purchasing power of a bitcoin, because you can't buy most things with bitcoin.

You might be able to find a land lord who is willing to transact in bitcoin, but your power bill is in dollars, your water bill is in dollars, your heating bill is in dollars, your phone bill is in dollars, the car dealership takes dollars, the insurance company takes dollars, and there isn't an alternative there. Virtually every grocer on the planet takes fiat currency and not bitcoin as well. You might be able to find some farmer somewhere who is willing to transact in bitcoin, but if you go to Sobeys or Safeway or Superstore, they want dollars. Even bitcoin miners deal in fiat currency because you need dollars to pay employees, to keep the lights on, to buy GPUs, and so on.

Even vendors who "take bitcoin" don't actually price anything in bitcoin because as the data already shows, the purchasing power of bitcoin is wildly unstable. What they actually do is convert the price of the thing in fiat currency to the equivalent number of bitcoin bought or sold on an exchange. When Tesla was selling their cars for bitcoin, they set the price in terms of how many bitcoin would buy against the car's price in US dollars the moment you started the purchasing process, and you could only press the purchase button for a short time, I think it was maybe an hour before the process reset and you'd need to get a new quote for purchasing the car in bitcoin because the price of bitcoin is highly unstable and they didn't want people getting a discount by preparing to buy the car when bitcoin was higher and finishing the purchase when bitcoin was lower. It's notable that they only continued this process until May of that year, so about 3 months total. They made an excuse about the environment, but I'm pretty confident the real reason they stopped is that bitcoin is a terrible method of exchange; Even with their pricing process being what it was, they couldn't immediately accept the bitcoin and convert it to fiat since it takes so long to process a bitcoin transaction.

Given all this, you have to judge its value compared to currencies whose buying power we know because despite their faults, they are a store of value, they are a unit of account, and they are a method of exchange.

Finally, there's the fact that you're a Canadian citizen, meaning that having a unit of account is very important because at the end of the day, you need to be able to tell the government how many equivalent Canadian dollars you made, and you need to convert some of your bitcoin into a percentage of your earnings, because you need to pay the government its taxes in Canadian dollars. Besides that, having to report income in Canadian dollars against a volatile currency makes taxation much more difficult because you not only have to record the transaction in bitcoin, but keep track of the exchange rate at the time so you can report the correct number of dollars.

Everything I wrote is cold hard reality. Sophistry isn't going to change the facts.

It's divorced from the reality of how bitcoin are created, how typical users would acquire bitcoin, how bitcoin would typically be used, how currency markets work, and perhaps most importantly what's required under the law at the end of the day.

Bitcoin are typically created by miners. These are people or companies running computer systems using either GPUs or ASICs that complete the equations that run bitcoin behind the scenes. There are two methods for the miners to get paid: For a little while longer just mining pays in bitcoin as the supply grows, but in addition you can attach fees to a transaction that the miner can collect. The miners then convert those bitcoin into fiat currency because they are in the business of making money. More on that in a moment.

It's possible to mine bitcoin yourself, but the amounts you'd need to live a life or run a business aren't possible to mine without an unreasonable investment in mining hardware and at that point you're just a miner. Typically, end users of bitcoin will trade their own fiat currency for bitcoin using an exchange. This is not unique to cryptocurrencies; if I were to take a trip to the US, I would have to use a currency exchange to convert my Canadian dollars to US dollars similarly.

You can't just pretend that bitcoin don't have value relative to other currencies, because currencies other than bitcoin aren't traded for in order to get rich; People around the world buy Canadian dollars, for example, because they want Canadian oil, or metals, or wood, or pulp and paper, or food products, or to stay in Canadian hotels or eat in Canadian restaurants or to hire Canadian engineering firms or contractors or to buy Canadian houses or to pay Canadian taxes. The worth of that dollar is in the goods and services you can buy with that dollar. You can say "oh, the value of a bitcoin relative to the USD doesn't matter" all you want, but if I can sell my bitcoin for enough to buy a new Tesla one year and I can sell my bitcoin for enough to buy a used Toyota Corolla the next, that's a real difference in what's sitting in my driveway, and you'll care how much you're getting paid in how much stuff you can buy a lot.

Since Bitcoin isn't a currency, it isn't a good store of value, isn't a unit of account, isn't a method of exchange, you can't measure the purchasing power of a bitcoin, because you can't buy most things with bitcoin.

You might be able to find a land lord who is willing to transact in bitcoin, but your power bill is in dollars, your water bill is in dollars, your heating bill is in dollars, your phone bill is in dollars, the car dealership takes dollars, the insurance company takes dollars, and there isn't an alternative there. Virtually every grocer on the planet takes fiat currency and not bitcoin as well. You might be able to find some farmer somewhere who is willing to transact in bitcoin, but if you go to Sobeys or Safeway or Superstore, they want dollars. Even bitcoin miners deal in fiat currency because you need dollars to pay employees, to keep the lights on, to buy GPUs, and so on.

Even vendors who "take bitcoin" don't actually price anything in bitcoin because as the data already shows, the purchasing power of bitcoin is wildly unstable. What they actually do is convert the price of the thing in fiat currency to the equivalent number of bitcoin bought or sold on an exchange. When Tesla was selling their cars for bitcoin, they set the price in terms of how many bitcoin would buy against the car's price in US dollars the moment you started the purchasing process, and you could only press the purchase button for a short time, I think it was maybe an hour before the process reset and you'd need to get a new quote for purchasing the car in bitcoin because the price of bitcoin is highly unstable and they didn't want people getting a discount by preparing to buy the car when bitcoin was higher and finishing the purchase when bitcoin was lower. It's notable that they only continued this process until May of that year, so about 3 months total. They made an excuse about the environment, but I'm pretty confident the real reason they stopped is that bitcoin is a terrible method of exchange; Even with their pricing process being what it was, they couldn't immediately accept the bitcoin and convert it to fiat since it takes so long to process a bitcoin transaction.

Given all this, you have to judge its value compared to currencies whose buying power we know because despite their faults, they are a store of value, they are a unit of account, and they are a method of exchange.

Finally, there's the fact that you're a Canadian citizen, meaning that having a unit of account is very important because at the end of the day, you need to be able to tell the government how many equivalent Canadian dollars you made, and you need to convert some of your bitcoin into a percentage of your earnings, because you need to pay the government its taxes in Canadian dollars. Besides that, having to report income in Canadian dollars against a volatile currency makes taxation much more difficult because you not only have to record the transaction in bitcoin, but keep track of the exchange rate at the time so you can report the correct number of dollars.

Everything I wrote is cold hard reality. Sophistry isn't going to change the facts.

The word didn't come into existence in 2012. Reality has a long tail going back a trillion years, human civilization has a recorded history going back 20,000 years, and central banks have a long tail going back generations.

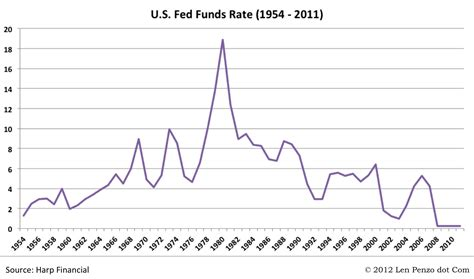

Reality check: Cryptos as a concept are only about 10 years old. Despite the magical lack of cryptos, CBs raised interest rates to reduce the money supply in the 50s, 60s, 70s, 80s, 90s, and 2000s. If we go by your prediction, you'd expect money supply should have increased less in the 2010s and onward since cryptos were there to "force them" to tighten money supply. Instead the opposite happened, and money has been printed more than ever before during the crypto era. That's an epic fail of a prediction.

The thing that causes CBs to act is the amount of buying power a currency has trading those dollars for real goods, services, or hard assets. When people are paying many more dollars for food, shelter, energy, that's what spurs CBs to action, not the price of fake Internet currency.

In reality, the scam crypto market actually likely moderates measurable inflation because dollars that might otherwise go into buying stuff that matters to Central Banks is going into trading around imaginary Techno Disney Dollars instead. It actually helps them print more money rather than forcing them to print less.

Reality check: Cryptos as a concept are only about 10 years old. Despite the magical lack of cryptos, CBs raised interest rates to reduce the money supply in the 50s, 60s, 70s, 80s, 90s, and 2000s. If we go by your prediction, you'd expect money supply should have increased less in the 2010s and onward since cryptos were there to "force them" to tighten money supply. Instead the opposite happened, and money has been printed more than ever before during the crypto era. That's an epic fail of a prediction.

The thing that causes CBs to act is the amount of buying power a currency has trading those dollars for real goods, services, or hard assets. When people are paying many more dollars for food, shelter, energy, that's what spurs CBs to action, not the price of fake Internet currency.

In reality, the scam crypto market actually likely moderates measurable inflation because dollars that might otherwise go into buying stuff that matters to Central Banks is going into trading around imaginary Techno Disney Dollars instead. It actually helps them print more money rather than forcing them to print less.

That's a key part of why it isn't a currency: the use case for crypto at the moment is you convert Fiat into crypto with the hope that in the future someone will pay you more Fiat than you spent for it. That's how all of these companies were structured, and why they all went under when cryptos started to go down in price.

The fact that hypothetically you could find some electrical company in Texas that might accept a Bitcoin as payment, and you might find some water company in Indonesia that might accept Bitcoin, and a farmer somewhere in England who might accept Bitcoin for food, and a bus driver in Bangladesh who might accept Bitcoin, that doesn't make it a currency. It means that certain people are accepting a speculative investment in lieu of money, and whether you like it or not, they're only doing one of two things with it: either they are holding on to it with the hope that they will get more fiat currency for the Bitcoin tomorrow, or they are converting it to fiat currency so that they can buy the things that they actually need using something that is in fact a store value, a unit of account, and a medium of exchange.

There are anecdotes of people trading a tulip bulb for a house during tulip mania in the 1600s, because the tulip bulb was so valuable that it was considered a good trade, but that doesn't mean that a tulip bulb was a currency, it was a widely speculative investment, and that's where all of their value came from. The high price of tulip bulbs were never going to make back the money that they were demanding in actual flower sales.

The fact that hypothetically you could find some electrical company in Texas that might accept a Bitcoin as payment, and you might find some water company in Indonesia that might accept Bitcoin, and a farmer somewhere in England who might accept Bitcoin for food, and a bus driver in Bangladesh who might accept Bitcoin, that doesn't make it a currency. It means that certain people are accepting a speculative investment in lieu of money, and whether you like it or not, they're only doing one of two things with it: either they are holding on to it with the hope that they will get more fiat currency for the Bitcoin tomorrow, or they are converting it to fiat currency so that they can buy the things that they actually need using something that is in fact a store value, a unit of account, and a medium of exchange.

There are anecdotes of people trading a tulip bulb for a house during tulip mania in the 1600s, because the tulip bulb was so valuable that it was considered a good trade, but that doesn't mean that a tulip bulb was a currency, it was a widely speculative investment, and that's where all of their value came from. The high price of tulip bulbs were never going to make back the money that they were demanding in actual flower sales.

Honestly, it doesn't need to be a yellow coin, and one of my favorite stories is a cautionary tale in this regard:

Once, aluminium was considered the most valuable precious metal. It was so valuable that Napoleon III had a set of aluminium dinnerware he showed off as an example of his wealth and power. It was so valuable that the tip of the Washington monument is capped with a 6 pound tip made out of aluminium, the largest piece of aluminium used at that time in history.

The thing is, it turns out that aluminium isn't some insanely rare metal, it's one of the most common metals on earth. Eventually, processes were developed to turn plentiful aluminium ores into the metal, and the price plummetted. Today, we make everything from disposable drink cans to vehicles with it. If you gave someone a 6 pound tip of aluminium, it wouldn't represent as much value as 2200 man-hours of labor, you can pick up that much in a manufactured item for less than a day's labor at minimum wage.

In such a way, gold and silver could become useless as monetary metals as well. If we were to perfect asteroid mining, for example, and we were able to economically exponentially increase the availability of the metals, then the rarity of gold would no longer be a limiting factor.

The benefits of using rare metals as money are twofold:

1. It keeps governments honest in terms of creating money. If the government wanted a dollar in 1900, then they needed to dig up approximately 1.5g of pure gold. Same with silver, you need the silver to have the silver. This isn't perfectly effective, since governments created "debasement" where they start with the base metal and add other cheaper metals until the currency is useless anyway.

2. It ensures there's a value floor on the currency. If you need a certain amount of a valuable metal to create a coin, then that coin will always be worth at least as much as the metal used to produce the coin. In fact, many countries considered their silver coins to be basically interchangeable at certain points in history since an ounce of fine silver is as good as any other ounce of fine silver. We've actually got a problem here today where our money has been so badly debased that even the crude facimiles are worth more in terms of their metals than the currency itself is worth, leading to us eliminating the penny because the copper coated zinc made no fiscal sense to issue, and I'm certain that within my lifetime other coins will also disappear.

Of course, despite what some people think, it isn't a perfect solution either.

1. It locks useful resources up in vaults and wallets, and that's bad because precious metals actually have good uses. When aluminium became widely available, it became used for many things it wasn't before, and gold and silver would likely be the same if it was equally available.

2. It also gives disproportionate power to miners. If I buy a computer from Dell, what business does a guy who owns a gold mine have getting in on that by selling the economy an ounce of gold that I'll solely use to tabulate the fact that I paid for the computer?

3. Fractional reserve banking sort of breaks the benefits of hard currencies, since you can have an economy that should have X dollars that instead has X+Y dollars where Y is dictated entirely by the banks. The danger of a bank run is built into the fact that fractional reserve banking is basically a scam where you tell two people they each have the same dollar.

4. Honesty just isn't very fun sometimes. Leverage and money printing are a two sided coin -- on one hand, the bad sides are that the value of people's hard work is degraded by the government's inflation tax, and the bust of the cycle means a lot of people get really badly hurt because they get in over their heads and take a lot of other people with them. On the other hand, the good sides are that inflation means debt is always shrinking at a certain rate, and there's always an incentive to make more money, and while the bust hurts, the boom feels great and sometimes something wonderful results from the risks people take during the boom such as our entire modern world.

Economics isn't simple because it isn't a hard science, it's a social science with hard constraints in the real world. If you have 1kg of bread you can't magic a second kg of bread into existence, but every single person can have a different opinion as to the value of that 1kg of bread and the aggregate of all those opinions matters, especially when people can choose to use their own resources to make more bread, or they can choose to consume their resources so there won't be any more bread, and a thousand other little things.

Once, aluminium was considered the most valuable precious metal. It was so valuable that Napoleon III had a set of aluminium dinnerware he showed off as an example of his wealth and power. It was so valuable that the tip of the Washington monument is capped with a 6 pound tip made out of aluminium, the largest piece of aluminium used at that time in history.

The thing is, it turns out that aluminium isn't some insanely rare metal, it's one of the most common metals on earth. Eventually, processes were developed to turn plentiful aluminium ores into the metal, and the price plummetted. Today, we make everything from disposable drink cans to vehicles with it. If you gave someone a 6 pound tip of aluminium, it wouldn't represent as much value as 2200 man-hours of labor, you can pick up that much in a manufactured item for less than a day's labor at minimum wage.

In such a way, gold and silver could become useless as monetary metals as well. If we were to perfect asteroid mining, for example, and we were able to economically exponentially increase the availability of the metals, then the rarity of gold would no longer be a limiting factor.

The benefits of using rare metals as money are twofold:

1. It keeps governments honest in terms of creating money. If the government wanted a dollar in 1900, then they needed to dig up approximately 1.5g of pure gold. Same with silver, you need the silver to have the silver. This isn't perfectly effective, since governments created "debasement" where they start with the base metal and add other cheaper metals until the currency is useless anyway.

2. It ensures there's a value floor on the currency. If you need a certain amount of a valuable metal to create a coin, then that coin will always be worth at least as much as the metal used to produce the coin. In fact, many countries considered their silver coins to be basically interchangeable at certain points in history since an ounce of fine silver is as good as any other ounce of fine silver. We've actually got a problem here today where our money has been so badly debased that even the crude facimiles are worth more in terms of their metals than the currency itself is worth, leading to us eliminating the penny because the copper coated zinc made no fiscal sense to issue, and I'm certain that within my lifetime other coins will also disappear.

Of course, despite what some people think, it isn't a perfect solution either.

1. It locks useful resources up in vaults and wallets, and that's bad because precious metals actually have good uses. When aluminium became widely available, it became used for many things it wasn't before, and gold and silver would likely be the same if it was equally available.

2. It also gives disproportionate power to miners. If I buy a computer from Dell, what business does a guy who owns a gold mine have getting in on that by selling the economy an ounce of gold that I'll solely use to tabulate the fact that I paid for the computer?

3. Fractional reserve banking sort of breaks the benefits of hard currencies, since you can have an economy that should have X dollars that instead has X+Y dollars where Y is dictated entirely by the banks. The danger of a bank run is built into the fact that fractional reserve banking is basically a scam where you tell two people they each have the same dollar.

4. Honesty just isn't very fun sometimes. Leverage and money printing are a two sided coin -- on one hand, the bad sides are that the value of people's hard work is degraded by the government's inflation tax, and the bust of the cycle means a lot of people get really badly hurt because they get in over their heads and take a lot of other people with them. On the other hand, the good sides are that inflation means debt is always shrinking at a certain rate, and there's always an incentive to make more money, and while the bust hurts, the boom feels great and sometimes something wonderful results from the risks people take during the boom such as our entire modern world.

Economics isn't simple because it isn't a hard science, it's a social science with hard constraints in the real world. If you have 1kg of bread you can't magic a second kg of bread into existence, but every single person can have a different opinion as to the value of that 1kg of bread and the aggregate of all those opinions matters, especially when people can choose to use their own resources to make more bread, or they can choose to consume their resources so there won't be any more bread, and a thousand other little things.

I agree with Jeff on this one. Banks that are run badly collapsing is a good thing.

Our society has a big problem: People take big risks to get rich, then when they become rich they buy politicians, and when the natural consequences of taking stupid risks occur and they're supposed to lose their money and power then the politicians step in and use our money and our kids money to bail them out.

When we remove the factors that limit bad behavior such as protecting banks from collapsing under the weight of their unmanaged risk, then we break the game, and suddenly the only way to succeed is to take big risks without any regard for the consequences. It's the famous privatizing the gains and socializing the losses. Meanwhile, the people who are responsible get out-competed since there's no benefit to doing the right thing.

From this point of view, it's predictable that the collapses would get bigger and bigger and we wouldn't learn any lessons from them.

I wrote a long paper on the monetary causes of virtually every recession in the US. Limit the money supply and make fractional reserve banking difficult to abuse and you'll end up with a nice boring economy, you won't need to take everyone's money and give it to the richest people every 10 years just to prevent a collapse.

Our society has a big problem: People take big risks to get rich, then when they become rich they buy politicians, and when the natural consequences of taking stupid risks occur and they're supposed to lose their money and power then the politicians step in and use our money and our kids money to bail them out.

When we remove the factors that limit bad behavior such as protecting banks from collapsing under the weight of their unmanaged risk, then we break the game, and suddenly the only way to succeed is to take big risks without any regard for the consequences. It's the famous privatizing the gains and socializing the losses. Meanwhile, the people who are responsible get out-competed since there's no benefit to doing the right thing.

From this point of view, it's predictable that the collapses would get bigger and bigger and we wouldn't learn any lessons from them.

I wrote a long paper on the monetary causes of virtually every recession in the US. Limit the money supply and make fractional reserve banking difficult to abuse and you'll end up with a nice boring economy, you won't need to take everyone's money and give it to the richest people every 10 years just to prevent a collapse.