And whether a malevolent concept to control opposition or a genuine belief, it is made worse by giving people a false sense of action and agency.

Conservatives almost cheer the next cultural incursion so that they can chuckle the phrase to themselves, confident that they are winning while losing.

Conservatives almost cheer the next cultural incursion so that they can chuckle the phrase to themselves, confident that they are winning while losing.

Also, is there an actual example of a company going woke then going broke?

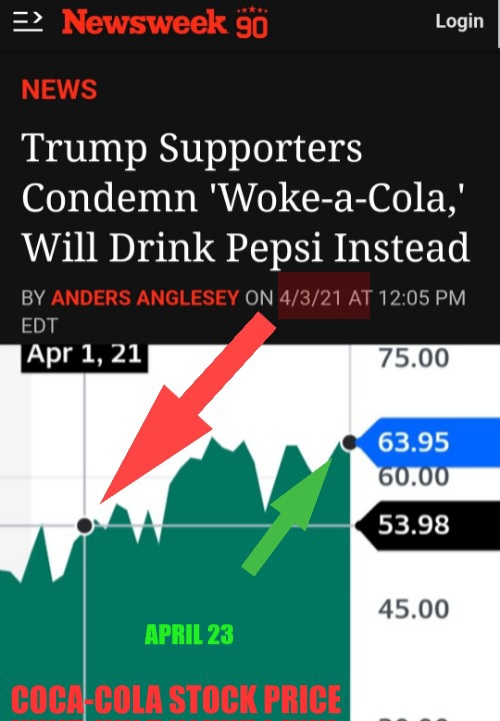

Example: it seems asking Conservatives to stay away from a specific brand of sugar water was an unrealistic level of self control..

Example: it seems asking Conservatives to stay away from a specific brand of sugar water was an unrealistic level of self control..

1. There is correlation between the two.

2. Conservatives need to wrap their heads around the fact that there is literally TRILLIONS available in ESG funds to prop up companies that "go woke" They are happy to exchange a temporary dip in sales to unlock access to that funding.

Anyway, looks like sales are doing well..

https://www.reuters.com/business/retail-consumer/coca-cola-beats-quarterly-revenue-estimates-steady-demand-2023-04-24/

> Revenue rose 4.3% to $10.96 billion, beating estimates of $10.80 billion

2. Conservatives need to wrap their heads around the fact that there is literally TRILLIONS available in ESG funds to prop up companies that "go woke" They are happy to exchange a temporary dip in sales to unlock access to that funding.

Anyway, looks like sales are doing well..

https://www.reuters.com/business/retail-consumer/coca-cola-beats-quarterly-revenue-estimates-steady-demand-2023-04-24/

> Revenue rose 4.3% to $10.96 billion, beating estimates of $10.80 billion

> You're either being fooled by massaged stats or not looking at the larger picture.

That is exactly my point from your example.

It is a temporary sales dip, yes, but let's check in twelve months from now shall we?

Meanwhile, inBev gains improved access to literally $53+ in esg funds.

https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

Which do you think their board cares more about?

That is exactly my point from your example.

It is a temporary sales dip, yes, but let's check in twelve months from now shall we?

Meanwhile, inBev gains improved access to literally $53+ in esg funds.

https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

Which do you think their board cares more about?

People were already not shopping there when they pulled the pillow Guy's pillows.

The internet killed them.

(Also maybe being over leveraged by private equity)

The internet killed them.

(Also maybe being over leveraged by private equity)

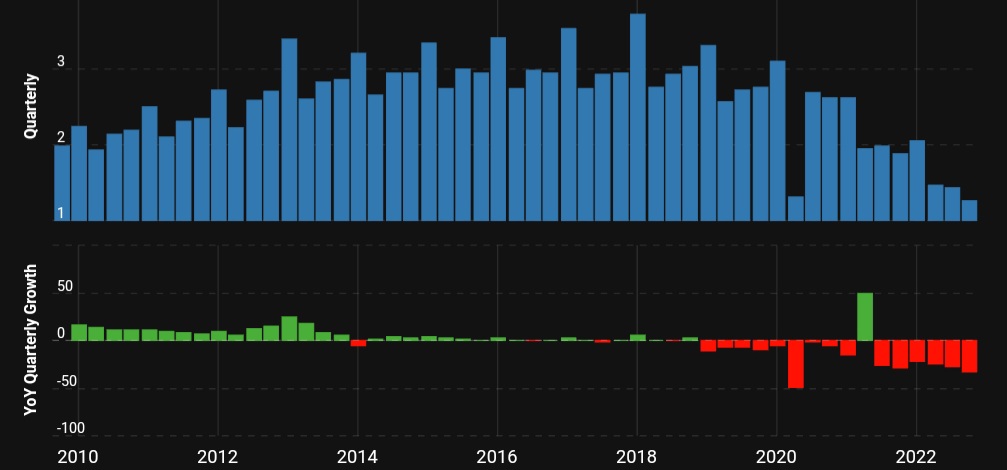

There isnt any evidence for them going broke from dumping his pillows, but if you look at stick price or revenue, they have been in decline since something like 2018.

https://www.macrotrends.net/stocks/charts/BBBY/bed-bath-beyond/revenue

https://www.macrotrends.net/stocks/charts/BBBY/bed-bath-beyond/revenue

- replies

- 2

- announces

- 0

- likes

- 1